*All dollar amounts are in Canadian dollars and monthly figures unless otherwise indicated.

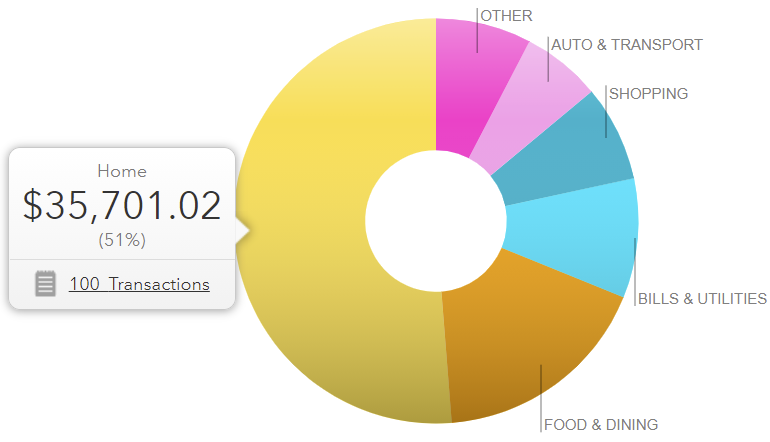

Our May 2020-April 2021 average monthly expenses were: $5460 /month ($65,525.42/year) for a family of 4, children aged 11 and 5 years old. This was a highly unusual year due to the Global Pandemic which forced many of us to delay or cancel vacations and limit spending on restaurants, movie theaters and other outings.

Home, sweet home ($35,701.02/yr or $2975.09/mo. 54.5% of expenses)

Our top expense category was, surprise, surprise: Home

– Equivalent to 54.5% of our expenses or 15.5% of our gross income.

– 3,006 sq ft home in South-Eastern Ontario (unfinished basement does not count in sq footage).

This comes hardly as a surprise to anyone in Canada, as our housing costs have sky-rocketed due to a supply shortage and a massive boom in buying activity fueled by rock-bottom interest rates to keep the economy afloat during Covid-19. However, we didn’t buy our house recently. As a matter of fact, this coming May 2021 will mark the 10-year anniversary since we moved to our then new home. I couldn’t imagine being able to buy a house like this in today’s market.

The Home expense category includes:

- Mortgage payments ($1,797 ~ 32% of our yearly expenses)

- Property taxes ($560)

- Home furnishings ($287): My 5-year-old graduated to an adult mattress and we decided our guest room should have a real bed and mattress. After 12 years of waiting to have a King-sized mattress, we finally splurged and passed moved our former mattress to the guest room.

- Home improvement ($228): Never stop improving is Lowes’ motto. Oh well this is mostly Hardware store purchases for storage solutions in closets, no major enhancements, but it sure adds up!

- Home Services ($161): Snow removal services and Ice Dam removal. That last one warrants another post.

Food and Dining ($1022 or 16% of expenses)

- Most of our meals are home-cooked.

- Groceries ($874)

- Restaurants ($137)

- We get Drive-Thru hamburgers once a week, and do curb-side pickup of Chicken Wraps (Pita Pit) once every couple of weeks. We haven’t sat in a restaurant since the beginning of Covid-19. Oh, we ordered a big meal from a Chinese restaurant for our wedding anniversary and the breaded everything (including meat strips!) or the MSGs they use when cooking, didn’t sit well with us and, ended up being a big disappointment.

Bills and utilities: $553/mo or 8.4% of expenses

Includes new Cell Phones and Cell Phone Service, Internet, Water, Hydro (electricity), Gas (heating, cooking).

Shopping (clothing, toys, gadgets): $445/mo or 8.1% of expenses

Includes Jumbo Square 4×4 Springfree trampoline ($2,485) which has kept kids busy and away from screens for a while during lockdowns.

Auto & Transport : $365 or 7.5% of expenses

*2 cars fully paid years ago; 11-year-old station wagon and 8 year old standard car.

I actually switched car insurance companies since CAA Auto gave me a better deal in exchange for connecting a device to track my driving. I realized that I’ve been more careful of not going over the limit and driving more smoothly. Hopefully I’ll get a discount after their 3 or 6 month initial data collection period.

Anything remarkable this year, investment-wise?

We took a Home Equity Line of Credit to invest $170,000 in some market opportunities. Not afraid to say it, we’re on our FIRE journey but in Bitcoin we trust.

Many in the FIRE community can be put off by such a “risky and volatile” investment vehicle but I believe in taking advantage of market opportunities when I possess abundant knowledge and built conviction in a given area. I identified an opportunity in Bitcoin in March 2020 and applied and obtained the said Line of Credit at Prime plus 0.5% or 2.95%/yr in April. This warrants a separate post, if you want to hear the details on how this investment has performed or how you can seize a similar opportunity in the future, let us know in the comments below.

2 Comments on “Monthly expenses breakdown in times of COVID-19 (2020-2021)”

Thank you for this breakdown! All the best for the rest of 2021!

Thanks Tressent, hope 2021 brings us all a clearer path back to life as usual!